does utah have an estate or inheritance tax

When a person dies in Utah someone becomes responsible for their estate. Twelve states and Washington DC.

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

However a beneficiary who lives in another state may have to pay inheritance tax if the beneficiarys state of.

. Its a very confusing situation says Anita. But even though there is no estate tax in Utah you may be assessed estate tax at the federal level. Utah does not have a state inheritance or estate tax.

There is no inheritance tax in Utah. The Utah State Tax Commission says this on its website. The state uses a flat tax rate of 495.

Easing Into The Subject Of Conservation Easements February 24 2015 - 949 pm. State Estate Tax in Utah. However there is still a federal estate tax that applies to estates above a certain value.

Instead of filing formal probate the person who is the heir will use an affidavit to claim the estate. Higher rates are found in locations that lack a. There is no federal inheritance tax but there is a federal estate tax.

And like all states Utah has its. The top estate tax rate is 16 percent exemption threshold. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

Certain tasks must be taken care of even while youre dealing with the loss of a family member. Federal changes phased out the national inheritance tax and therefore. Utah does not have a state inheritance or estate tax.

The short answer is no. Its actually is not that uncommon. Explanation of Utah estate or inheritance tax gift tax credit shelter trust and more.

Eight states enforce an inheritance tax and two states New Jersey and Maryland impose both an estate and an inheritance tax. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME. Utah does not have a state inheritance or estate tax.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. The inheritance tax is different from the estate tax. 117 million increasing to 1206 million for deaths that.

Only estates that reach a legally defined threshold are subject to the estate tax. Call 801 438-2022. Alaska is one of five states with no state sales tax.

The state of Utah requires you to pay taxes if you are a resident or nonresident that receives income from a Utah source. Inheritances that fall below these exemption amounts arent subject to the tax. A Utah Medicaid Primer 101 February 24 2015 - 950 pm.

The inheritance tax applies to money after it has been passed on to beneficiaries who are responsible for paying the tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. A federal estate tax is in effect as of 2021 but the exemption is significant.

Fortunately Utah does not assess an estate tax. This exemption also applies to a married couple who can handle. However localities can levy sales taxes which can reach 75.

Most states dont levy an inheritance tax including Utah. In general Utah is a low taxing environment. The Utah Trust Estate Educational Resource Center.

Only 12 states have an estate tax. Additionally Utah has no estate or inheritance tax.

Environmental Lawyer In Salt Lake City Family Law Attorney Divorce Lawyers West Jordan Utah

Utah Estate Inheritance Tax How To Legally Avoid

A Guide To Inheritance Tax In Utah

Lawyer To Get Inheritance In Utah Divorce Lawyers Divorce Divorce Attorney

Why You Need A Will Probate Divorce Lawyers Attorneys

A Guide To Inheritance Tax In Utah

Historical Utah Tax Policy Information Ballotpedia

A Guide To Inheritance Tax In Utah

Utah Estate Tax Everything You Need To Know Smartasset

Utah Probate Filing Fees Probate Family Law Attorney Divorce Lawyers

Utah State Income Tax Calculator Community Tax

Wills And Trusts Probate Estate Planning How To Plan Estate Planning Attorney

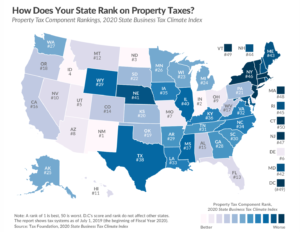

Utah S Property Taxes Continue To Be Recognized As One Of The Best In The Nation Utah Taxpayers

Utah Estate Tax Everything You Need To Know Smartasset

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account

Utah Estate Tax Everything You Need To Know Smartasset

Child Support Collection From Social Security Child Support Back Child Support Child Custody

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Family Law Attorney